The conceptual framework ''sets out the concepts that underlie the preparation and presentation of financial statements. It is a practical tool that assists the IASB when developing and revising IFRSs'' (Conceptual Framework, para. 1). When standards do not provide guidance or sufficient guidance on a particular transaction, the conceptual framework is referred to provide guidance.

There are two fundamental qualitative characteristics of useful financial information according to the conceptual framework:

1) Relevance (Materiality is only part of relevance, it is not a fundamental nor an enhancing qualitative characteristic)

2) Faithful representation

The four enhancing qualitative characteristics of useful financial information according to the conceptual framework:

1) Comparability

2) Verifiability

3) Timeliness

4) Understandability

The lessor must firstly recognise the lease as either finance or operating lease.

If the lease is classified as a finance lease, the underlying asset is treated as though it is disposed of without gain or loss on disposal of asset in the beginning of the lease.

If the lease is classified as an operating lease, the underlying asset remains in the balance sheet of the lessor. The asset will still be depreciated normally.

In essence, they are three types of employee benefits:

1) non-accumulating - the benefit is restricted to a particular year and employees cannot carry forward their entitlements to future periods.

- These costs are recognized when it occurs eg wages and salaries

2) accumulating and non vesting

- the employees can carry forward their entitlements to future periods (accumulating) but employee is not compensated for any unused entitlement if the employee resigns or is terminated (non vesting)

- Provisions of these costs are recognized on the probability that the leave will be taken within 12 months after reporting year end eg sick leave

- these costs are measured at the undiscounted amount the entity expects to pay within 12 months after reporting year end

3) accumulating and vesting

- the employees can carry forward their entitlements to future periods (accumulating) and the employer has to make a payment to the employee for the benefit even if the employee resigns or is terminated (vesting).

- Provisions of these costs are recognized as the employee render their services that increase their entitlement to future compensation eg long service leave and annual leave

- the nominal or undiscounted amount must be used if the entity expects these costs to be settled within 12 months after reporting year end

- these costs are measured at the present value of the amount the entity expects these costs to be settled over 12 months after reporting year end

Short-term compensated absences

Short-term compensated absences are to be settled before 12 months after the end of the annual reporting period in which the employees render the related service. This means a provision for these short-term compensated absences has to be recognized at the undiscounted amount expected to be paid on settlement within 12 months after reporting end. Short-term compensated absences include annual leave and sick leave (IAS 19, para. 9). Question 1.10 in the study guide showcases the calculation for sick leaves which is a short-term compensated absence and also an accumulating and non vesting compensated absence.

Long-term compensated absences

A provision should be recognized by the present value method if absence is to be settled over 12 months after year end reporting or at the undiscounted amount if absence is to be settled within 12 months. Example 1.4 showcases the calculation for sick leaves which is a long-term compensated absence and also an accumulating and vesting compensated absence.

They are two types of share-based payment transactions, cash-settled and equity settled. Share-based payment transactions are measured as follows:

1) cash-settled- This is where the cash payment of goods and services depends on the fair value of the equity subject to other variables with respect to the equity (like cash bonus to employees according to the share price of 1000 shares times 10). As such no equity instrument is actually granted with regards to the payment of the goods and services.

- initially recognized at the fair value of the goods or services.

- the liability is remeasured at the end of each reporting period with changes in the equity instrument recognized in profit and loss if not yet settled

2) equity-settled- This is where the entity grants its own equity instruments in order to pay for goods or services

- measure the goods or services based on their fair value if such goods and services can be reliably measured

- measure the goods or services based on the fair value of equity instruments granted if such goods and services cannot be reliably measured

Example cash-settled share-based paymentsAt 31 May 20X7 a bonus expense was recognised in lieu of a companys' sales persons performance. The bonus payment is 10 times of the share price of 100000 ordinary shares.

At 31 May 20X7 a share price was $2 each.

At 30 June 20X7 (the year end reporting date) a share price was $1.50 each

At 31 July 20X7 the bonus payment was eventually settled when a share price was worth $2.50 each.

What are the journal entries at 31 May 20X7, 30 June 20X7 and 31 July 20X7?

Example equity-settled share-based payments

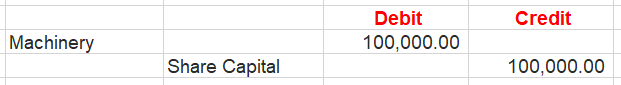

Adam bought machinery fair valued at $100000 from Sam by issuing 100000 shares valued at $2 each. What is the journal entry from Adams perspective assuming the shares are immediately vested on delivery of machinery?

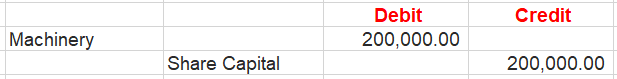

Using the same facts as above but assume the machinery cannot be reliably measured. What is the journal entry from Adams perspective?

IAS 40 Investment property (not to be confused with PPE accounted for under IAS 16) is defined IAS 40, para. 5, as:

property (land or a building—or part of a building—or both) held (by the owner or by the lessee as a right-of-use asset) to earn rentals or for capital appreciation or both, rather than for:

(a) use in the production or supply of goods or services or for administrative purposes; or

(b) sale in the ordinary course of business.

After the initial recognition of the investment property, an entity may choose to subsequently recognize the investment property either the:

A) cost model which is basically depreciation OR

B) revaluation model where all gains and losses arising from a change in the fair value of investment property is recognized in profit and loss (p&l).

Note that situations where companies can use more than one measurement method like investment properties where a companies can choose between the cost or revaluation model reduces the enhancing qualitative characteristic of comparability.